Opinions expressed here are the author’s alone, not those of any bank, and have not been reviewed, approved, or otherwise endorsed by any of these entities.

Every business needs a bank account. In today’s digital world, many organizations are turning to online banks. Whether you run a startup or a multi-million dollar corporation, one of these online business banking solutions is sure to fit your needs.

Top 11 Online Business Banking Accounts

Below, you’ll find a review for all of our top picks for different situations.

- Mercury* — Best banking for startups

- Relay — Best for flexible business banking

- Lili – Best for small businesses poised for growth

- Bluevine — Best for small business

- Novo — Best for entrepreneurs and ecommerce

- Found — Best for freelancers and self-employed

- Chase Business Complete Banking® — Best branch access

- NorthOne — Best for fully mobile business banking

- Axos Bank — Best way to include your employees in your online banking

- BankProv — Best checking accounts with full deposit insurance

- LendingClub Bank — Best for businesses with tons of transactions

From freelancers and startups to ecommerce stores and those needing extra flexibility, most people will get everything they need from one of the banking options above.

*Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust, Members FDIC.

This guide highlights the type of online accounts each bank offers, including prices, benefits, and other online banking solutions they provide.

Then you’ll find the methodology we used to select the best online business banking solutions, and how you can use the same criteria to find the one for your business needs.

The Best Online Business Banking Reviews

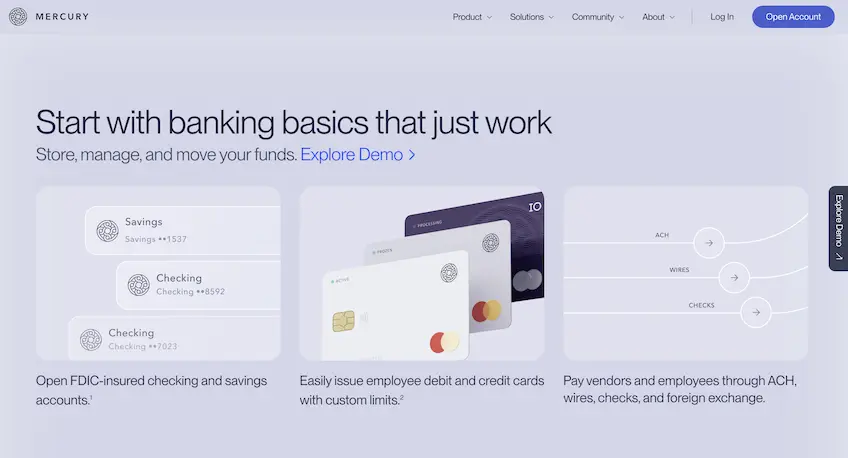

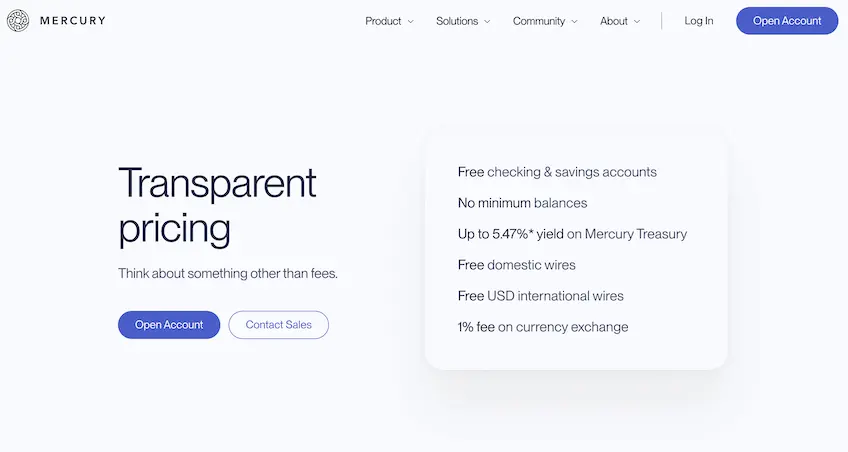

Mercury — Best Banking for Startups

Mercury is our top choice for startups–it’s just as flexible and convenient as many of its competitors, but it allows you to pay employees, issue employee debit and credit cards, and sync your accounts with the tools you already use.

This is a big deal. A number of the top online banking services are great if you are a single-person business, but once you start really growing, those lightweight services can’t keep up.

Mercury, on the other hand, has all of the tools and services a founder needs to build their company. Through its partner banks, Mercury provides FDIC-insured U.S. bank accounts to global businesses.

Think of it as a traditional banking* backbone with a modern front end designed for today’s companies. Integrations and open API access mean you can tie your bank into the rest of your business.

With Mercury, you can create virtual debit cards and track your cash flow. You can also easily manage Shopify, Stripe, Amazon, and PayPal integrations.

Move money around with ease, issue physical and digital cards to your employees, and capture every transaction in clear reports.

Mercury has zero monthly fees, zero minimum balance requirements, and many reasons to sign up:

- 100% online banking, never set foot in a bank branch again

- Sign up in minutes from anywhere in the world (non-US residents welcome)

- Create checking & savings accounts

- Create virtual & physical debit cards

- Link seamlessly with Stripe, PayPal, Shopify, and other payment processors

- Integrate with Pilot, Xero, Quickbooks, and more

- Intuitive payments (wire, check, ACH)

- Easily searchable transactions

- Custom user permissions

- Automated vendor payments

On top of all of these appealing features, you can opt to use one of two safe ways to store your extra cash. We think these two tools that follow are the most compelling arguments for using Mercury as a startup or other young tech operation.

Mercury Treasury lets you earn up to 5.47% on your idle cash with minimal work on your end. While there are no opening fees or transactional fees associated with Mercury Treasury accounts, you will be charged a small percentage of your total positions. Fees are based on your balance, starting at 0.05%

Yields are also based on how much you’re depositing, and there’s a $500,000 minimum opening deposit to qualify for Mercury Treasury. But according to the website, Mercury “hoping” to make this available to all deposit amounts at some point in the future.

On the more traditional savings side of things, Mercury Vault protects your funds to an extent few other startup-minded fintech companies do. Keep any amount of cash in the Mercury Vault with deposits FDIC-insured up to a very generous $5 million and no need to split funds or open discrete accounts. All Mercury accounts have Vault available to utilize.

Beyond checking, saving, and high-yield accounts, Mercury also offers a range of other business services—including fundraising options for Pre-Seed, Seed, Series A funding, and more. They offer venture debt options for qualifying businesses and a massive database to help you find investors who specialize in your industry.

You can get corporate credit cards through Mercury, with unlimited 1.5% cash back and high credit limits.

Get started by opening a Mercury account today for free.

*Mercury is a financial technology company, not a bank. All banking services are provided by Evolve Bank & Trust®, Member FDIC.

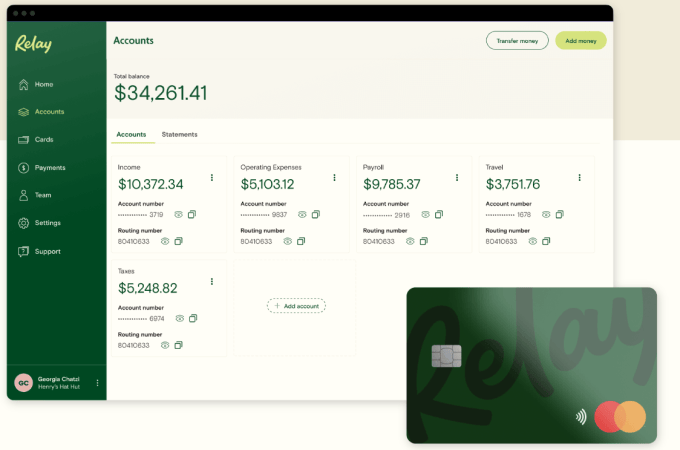

Relay — Best for Flexible Business Banking

Relay is a fee-free online business banking solution that has a few money management capabilities that the others don’t.

You can create up to 20 checking accounts on Relay’s free online banking platform and issue up to 50 Mastercard debit cards. These may be physical or virtual debit cards, and yes, you can set individual spending limits and ATM withdrawal limits on all cards.

New virtual debit cards you issue from your Relay account are activated instantly. Physical cards take about 8-10 days to arrive in the mail.

Adding or editing your checking accounts is just as easy. And with the ability to create up to 20 accounts, you can manage your money your way.

Want to set up a second business within your existing Relay account? Not a problem.

You can assign read-only or administrator privileges to each user and control who gets access to each new account.

Some of the other compelling reasons to choose Relay include:

- No overdraft fees

- Free ACH transfers

- Mobile check deposits

- Domestic and international wire transfers

- 55,000 fee-free ATMs

- Payroll and accounting integrations

- 24/7 phone, email, and chat support

- FDIC-insured* up to $2.5 Million

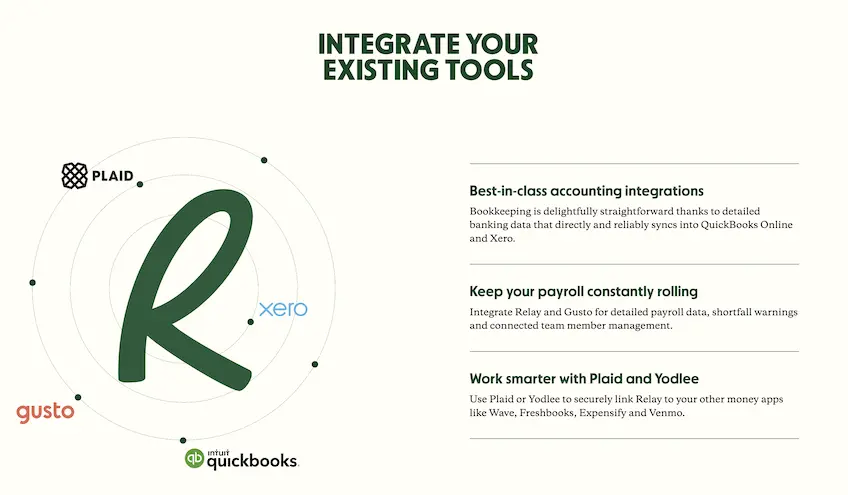

Relay offers a complete online banking experience with very few fees. You’ll also benefit from direct integrations with popular platforms like QuickBooks, Xero, Gusto, Plaid, and more.

Everything we reviewed up to this point comes with free Relay business banking plans.

The accounts payable features are available by upgrading to Relay Pro ($30/month per business). This lets you automate bill payments, consolidate vendor payments, and further streamline operations.

Relay Pro also waives the fees for outgoing wire transfers and provides same-day ACH delivery.

You can open up to 20 different checking accounts to separate your finances and organize everything into unique buckets.

If you want to put your money to work, you can open up to two savings accounts through Relay and earn between 1% and 3% APY based on your balance.

At the end of the day, Relay offers a lot more flexibility than other leading online banking solutions. It’s fast and free to create plenty of accounts or provide your employees with a secure debit card.

*Relay is a financial technology company, not an FDIC-insured bank. Banking services and FDIC insurance are provided through Thread Bank and Evolve Bank & Trust; Members FDIC.The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

Lili – Best for Small Businesses Poised for Growth

Lili is an online banking app that delivers a ton of value for businesses of every size. Whether you’re a sole proprietor, single- or multi-member LLC, partnership, or S Corporation, Lili has you covered.

Like our other recommendations, Lili is flexible, modern, and free of hidden fees. Where it steps apart are the built-in tools for expense management and invoicing.

Instead of having to hook up two or three apps, you can get everything done in Lili. It’s easy to scan receipts, categorize expenses, and set aside money for taxes throughout the year. Come tax time, Lili will actually pre-fill your 1040 Schedule C if everything is ready to go.

It’s just so simple to stay on track with Lili. You can create, send, and store every invoice directly in the app. There are no limits to the number of invoices you can send, and you can customize them by adding your business’s logo.

Lili doesn’t have a deep set of integrations with other software. But you can do a lot more within the app itself than many other business banking solutions. This can be a huge advantage for small business owners who don’t want to rely on multiple apps just to complete simple transactions.

If you are just starting out, Lili Basic may have all that you need. There are no fees and no minimum balance required. You’ll get a Visa business debit card with no ATM fees at more than 38,000 locations nationwide.

But if you’re looking for more, you can upgrade to a higher plan tier.

Lili Pro – $15 per month

- 4.15% APY on Savings

- Advanced business checking account

- Automatic tax savings

- Expense management tools and reports

Lili Smart – $35 per month

- Bookkeeping tools

- Financial reports

- Unlimited invoices and payments

- Pre-filled business tax forms

Lili Premium – $55 per month

- Dedicated account specialist

- Priority support

- Metal Visa Business Pro debit card

All Lili accounts are FDIC-insured, and all paid plans come with free overdraft protection up to $200, and you can try them for free with a 30-day trial.

Regardless of the plan you choose, there’s no minimum deposit required to open an account.

Get all your banking done anywhere, anytime with Lili Web or the sleek mobile application. Log in whenever it is convenient on any of your devices.

It only takes a few minutes to sign up. Find out more and apply for a Lili account today.

Bluevine — Best for Small Business

Bluevine is an online banking service that’s tailor-made for small businesses.

Their business checking is one of the best ones we’ve seen on the market. In fact, it even earned them a spot on our best business checking accounts list.

With no monthly maintenance fees, no minimum deposits or account balances, and no “insufficient funds” fees, it’s an entrepreneur-friendly solution for small business owners looking to save money and avoid being nickel-and-dimed by their bank.

Bluevine also offers eligible customers a full 2.0% interest on their business checking balance up to and including $250,000. That’s more than 50 times the national average!

Earning 2.0% APY is hard to beat, and that doesn’t even account for all of the other features, such as contactless payments and no incoming wire transfer fees.

If you’re a business owner who wants to protect your money from being diminished by fees and watch it grow as it sits in your account, Bluevine is a great option.

It also has an ATM network of 38,000 locations that have no surcharge through a partnership with MoneyPass. The downside is if there isn’t an in-network ATM near you, you’ll get hit with an ATM fee.

In addition to a great business checking account, Bluevine now allows customers to add up to five sub-accounts to any business checking account. These sub-accounts allow users to manage their money better and give them more flexibility than ever.

Eligible Bluevine accounts are FDIC-insured up to $3 million per depositor through Coastal Community Bank and other Bluevine program banks.

While Bluevine’s Standard business checking account is great (and always free), you’ll also have the option to sign up for or upgrade to a Bluevine Premier account. This comes with everything offered in the Standard account, plus:

- 4.25% APY on cash

- 50% off the standard payment fees

- Priority customer support

There’s no minimum balance for a Bluevine Premier Account. However, there is a $95 monthly fee. This monthly fee can be waived if you maintain a $100,000 balance each period and spend at least $5,000 on your Bluevine debit card per period.

Bluevine also prioritizes security. In addition to the basics, like two-factor authentication and data encryption, you’ll also be alerted via text message about any suspicious transactions or account activity.

Learn more about the benefits and terms of Bluevine. Overall, we highly recommend Bluevine to any small business owner who wants a flexible banking experience.

Novo — Best for Entrepreneurs and Ecommerce

Novo is our top choice for entrepreneurs and ecommerce. It’s built for the pace of commerce today, with a mobile app that lets you make payments, send invoices, and transfer funds. The ability to scan checks and manage other common banking tasks makes your life so easy. That’s because nothing takes more than a few swipes on your phone.

We love Novo for entrepreneurs because of the wide array of integrations to help slot it into your business’s current infrastructure.

That includes integration with Quickbooks and Xero for your accounting and bookkeeping needs, Zapier for your CRM, email, or marketing, Shopify and eBay if you have an ecommerce presence, Stripe for payment processing, and Amazon for sales and revenue tracking.

Novo offers many features and benefits, including:

- No monthly service fees or hidden fees

- Refunds at all ATMs up to $7 per month

- Free incoming and outgoing ACH transfers

- Free domestic and foreign wires

- Free mailed bank checks

- No minimum balance requirement

- No NSF fees

- Up to 20 Novo Reserve accounts

You’ll also benefit from discounts on business tools like HubSpot, Salesforce, Zendesk, Google Cloud, and Stripe. And Novo even offers a great mobile app that lets you handle all of your business financial needs from your phone.

One of our favorite features Novo offers is its free, unlimited, customizable invoicing. You can create personalized invoices in seconds without worrying about monthly limits or extra fees. To make it even better, Novo has recurring payments for invoicing.

In addition to online checking accounts, Novo also provides business loans in the form of cash advances to eligible merchants. You can get up to $75,000 with monthly factoring rates as low as 1.5% with instant access to funds if you’re approved. While you don’t necessarily need to have a checking account with Novo to apply for a loan, it’s nice to organize and manage all of this from a single bank and dashboard.

It takes less than ten minutes to apply for a Novo checking account. The minimum to open one is $50, a relatively low amount when compared to others.

Overall, Novo offers a basic, online-only small business checking for business owners seeking simplicity. If you’re a business owner who only needs a checking account, Novo is a great solution. However, if your needs extend beyond that, you should consider another option on our list.

Found — Best for Freelancers and Self-Employed

Found offers some of the best online banking services for people who are self-employed. Everything you need to manage payments, invoices, and taxes in a single app.

Unlike many of their competitors, Found is not offering a stripped-down version of their full business banking. Instead, Found was created from the ground up to serve people that run their own show.

Create and send invoices in Found instead of having to jump between multiple apps. Take or make payments, it’s all tracked in one place.

Connect Found with Square, Cash App, PayPal, and other popular payment gateways. Make it as easy as possible for people to pay you–never a bad thing.

Expense tracking and categorization on the mobile app are about as easy as it gets. You don’t need to be an accountant to save yourself a ton of stress come tax time.

The light, streamlined experience with Found comes with tradeoffs. For example, you’ll probably want to consider another more comprehensive banking service if you have W2 employees or plan to in the near future.

It lacks fancier reporting features, but not for the typical self-employed business owner. In their case, the automatic P&L, income, and expense reports in Found are perfect.

Found Plus is an optional paid subscription that includes additional bookkeeping features, photo receipt capture, and lets you make in-app quarterly tax payments.

You can set up a Found account in about five minutes. There’s no credit check, no opening fee, no minimum balance. Found offers a Mastercard Business debit card with instant alerts on all transactions.

Please note that Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The Found Mastercard® debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

For people that need simple small business banking, this should be at the top of your list. Visit Found to get started today.

Chase Business Complete Banking® — Best Branch Access

A Chase Business Complete Banking® account is a great choice for those who need both an online and in-person bank.

For example, if your business frequently deals in cash or international currency, Chase can be good for you because you can go to an actual teller when you need to.

Yes, other banks have online and physical locations—but no one holds a candle to Chase’s accounts offerings. You’ll have access to more than 4,700 branches and 15,000 ATMs for unrivaled convenience.

Want to open a savings account or explore company credit card options? With Chase it’s as simple as talking to customer service, which is available 24/7.

Those online-only banks are great if you have extremely simple needs. But if a lot of your customers pay in cash, or you require a few different types of bank accounts for your business, Chase will be a much more fitting partner in the long-term.

You’ll be able to accept all major debit and credit card payments anytime, anywhere with the Chase QuickAccept® card reader. Of course, your sales are tied right into your checking account, and Chase will deliver same-day deposits for no additional fee.

With everything in one place, Chase makes banking as simple and secure as possible.

Other online banking options might rely on several different services to get such transactions done–assuming all the integrations work–whereas Chase Business Complete Banking® keeps everything in a single system.

With the Chase Business Online web portal and mobile app, you get to manage your business’ finances on your own terms. You can rest assured that Chase is monitoring your account for fraudulent activity and will alert you of anything suspicious.

While there is a $15 monthly service fee, Chase gives you several ways to waive this fee, like maintaining a minimum daily balance or making purchases on your Chase Ink Business credit card.

In addition to checking accounts, Chase also has some of the best business credit cards on the market today. You’ll also benefit from exceptional merchant services and online business lending solutions if you need them.

Overall, if you’re looking for a good online banking experience that’s complemented by in-person physical locations, it’s hard to find a better service than Chase. Earn up to $300 when you open a new Chase Business Complete Checking® account today.

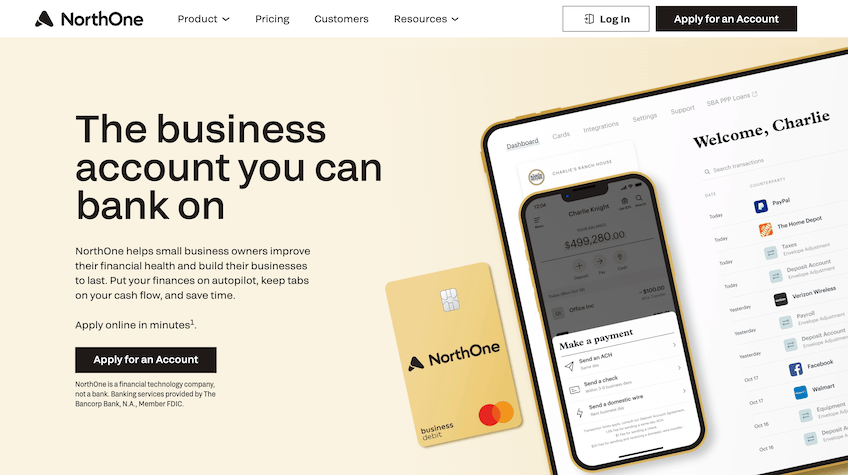

NorthOne — Best for Fully Mobile Business Banking

Modern business runs 24/7, and you can’t wait on “banker’s hours” to solve issues that arise. That’s exactly why NorthOne made our list.

It takes as little as three minutes to open an account. There is no minimum balance and you can cancel at any time.

Say goodbye to red tape, paperwork, and trips to your local branch. Everything can be done through NorthOne’s mobile web portal or mobile app, giving you round-the-clock banking access.

You can send ACH or wire payments, deposit checks with your phone camera, and create and send invoices with NorthOne’s separate free app.

Small business owners, startups, freelancers, and folks with multiple independent revenue streams can all enjoy the benefits of NorthOne’s branch-free banking.

You also get a NorthOne debit Mastercard for purchases and ATM withdrawals. You can freeze lost cards and order new ones through the mobile app, as well.

NorthOne also integrates seamlessly with a wide variety of other software. From accounting tools like QuickBooks and top payment processors like PayPal and Stripe to the arenas where your business happens like Amazon, Shopify, or even Etsy—you can rest assured there won’t be any hiccups with weaving NorthOne into your business suite of technology.

One unique standout of NorthOne is its Envelopes feature. This is great for businesses that like to allocate different funds for various expenses into different buckets. Rather than having to open separate accounts, NorthOne lets you set up different envelopes to help you budget accordingly.

You can even set it up so a specific percentage of incoming money automatically gets sent to particular envelopes, so it’s put on autopilot for you.

Pricing for NorthOne business banking is fantastically simple. It’s just $10 per month with no extra fees for deposits, purchases, integrations, or ACH payments. The only thing to be aware of is the $20 charge for sending or receiving a domestic wire transfer.

There’s also a marginal $1 fee for physical checks. But other than that, it’s a steady $10 each month with no surprises.

Get your first month free with NorthOne. There are no commitments, just the opportunity to make banking easier. You can apply for free in less than three minutes.

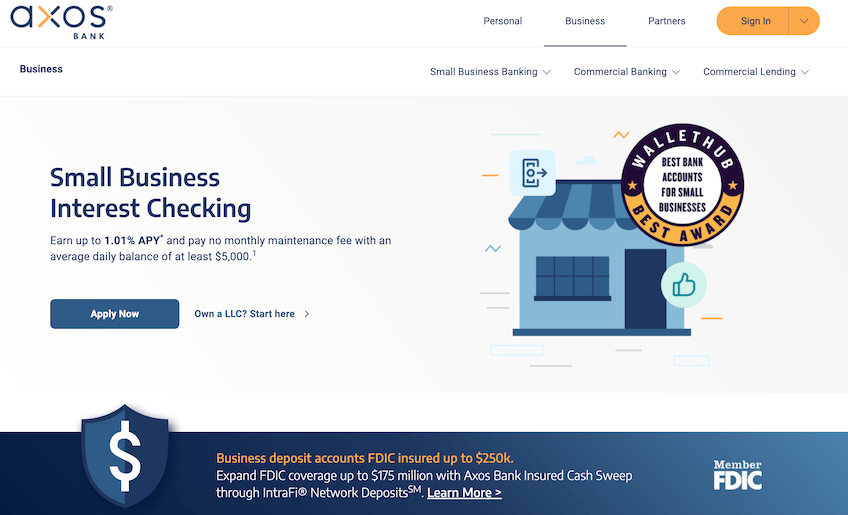

Axos Bank — Best Way to Include Your Employees In Your Online Banking

Axos Bank offers a suite of great banking solutions, including business checking, interest checking, business savings, CDs, and CDARs.

At first blush, its accounts don’t stand out all that much— until you look at the offers that show up after you open an account.

Its Workplace Banking product is one of these standout offerings.

This service allows you to provide banking solutions to all of your employees. You’ll be able to provide them Axos no-fee checking accounts with unlimited ATM fee reimbursement and low-interest rates for home, auto, and personal loans.

Axos will also provide your business with a financial literacy portal that includes nearly 200 tutorials and videos to guide your employees to financial success.

It’s a versatile benefit to offer your employees that can work for a lot of different companies. Be it access to no-stress checking accounts, better-than-average access to loan options, or just tools to get better at managing money, a benefit like this is a great addition to your incentive package to help you recruit and retain great talent.

When it comes to account specifics, here are a few key offerings of Axos’ Business Interest Checking account:

- Earn up to 1.01% APY

- $100 minimum opening deposit

- Pay no monthly maintenance fee with an average daily balance of at least $5,000

- Unlimited domestic ATM fee reimbursements

- Up to 50 free transactions per month, $0.50 per item thereafter (includes debits, credit, and deposited items)

- Up to 60 items per month for Remote Deposit Anywhere (includes monthly per item processing limitation)

- Cash deposits via MoneyPass and AllPoint networks

- No annual fees

Axos also offers promotional perks. New business owners that maintain a minimum average daily balance of $50,000 can earn a $400 bonus just for opening a business checking account by January 31st using the promo code NEW400 on their application. Plus, Axos clients receive four months of free subscription to ADP payroll services.

This is a good choice if you need a solid suite of business banking options, combined with a way to help your employees with their banking needs.

You can apply online today at Axos Bank’s website.

BankProv — Best Checking Accounts with Full Deposit Insurance

It’s something we take for granted—when you put money into your account, you expect nothing to go wrong. And especially in business checking, you never want to deal with the headaches and resolution process if something does go awry with your deposits.

BankProv business account holders have their deposits insured by the FDIC for up to $250,000. There is also the Depositors Insurance Fund (DIF) to protect every penny beyond that.

This level of protection is not something many other online business checking accounts offer. All DIF member banks are FDIC-insured, but not necessarily vice versa.

What does all this mean for you? Every deposit you make into a BankProv business checking account is fully insured, no matter what.

After all, you’re in business to make serious money, so why cap protection at only $250,000? You want a bank that will protect you once your account grows beyond a quarter of a million dollars.

If you’re a startup in serious fundraising mode, BankProv’s DIF insurance is that much more important. You can secure capital to raise your bank account well above $250,000 and not worry about the protection for any of your deposits, regardless of your bank balance.

BankProv offers five business checking packages that work for a range of entity sizes.

The Classic Business and Small Business tiers have no minimum deposit requirement, with the former having no monthly fee and up to 50 free deposited items.

Small Business checking has a monthly fee of $50 but unlimited free deposited items. You can also halve or waive the monthly fee entirely by keeping a balance of $100,000 or $250,000, respectively.

BankProv also offers three higher octane plans for larger organizations, with minimum deposit requirements of $25,000, $500,000, and over $1 million. Each unlocks wider benefits, such as free incoming wire transfers, corporate data reporting (only available on the two highest-tier plans), and higher thresholds for free ACH payments.

If you want to blow past the quarter-million mark without worry, go with BankProv. They’ll protect all of your deposits while also offering lending expertise in emergent industries like cryptocurrency and green technology.

LendingClub Bank — Best for Businesses with Tons of Transactions

LendingClub Bank offers four banking solution options, making it a fantastic solution for scaling and growing your business.

They offer business checking accounts, business high-yield savings accounts, CDs, and commercial deposit services for businesses.

Some of these solutions are built for large organizations, but we’re focusing on their Tailored Checking account, as it’s the best for the vast majority of high-volume small businesses.

However, it is reassuring to know that big-league offerings are there if and when your company begins to really grow.

Tailored Checking accounts come with:

- Unlimited transactions

- 1.50% APY for balances up to $100,000, then .10% APY for any balance beyond that

- $10 monthly fee (waived with balances over $500)

- No minimum balance requirements ($100 to open)

- Free worldwide ATM network

What we love about this bank most of all is its allowance of unlimited transactions. Most banks require you to pay some fee after a certain amount of transactions each month.

For example, Axos bank only allows you to have 200 transactions each month before you need to start paying a fee of $0.30 per transaction. Some banks even charge as high as $25 per transaction! That can add up quickly for many businesses.

Not LendingClub Bank. It will let you run as many transactions as you need without penalizing you. That’s great for businesses that handle a high volume of transactions each month or have high-octane growth as a top priority.

Tailored Checking also comes with unlimited 1% cash back on online and signature-based credit transactions made with your debit card.

It’s also worth noting that you get 0.75% APY on balances of more than $5,000. Though it’s easy to point at Bluevine and say that their 2.0% is better, this is actually more lucrative for big businesses since LendingClub Bank doesn’t cap their balance requirements for interest. That means you can have $5,000 or $1,000,000 in their checking account and you’ll still be earning 0.75% APY.

One potential downside is that it does require a $10 monthly fee along with $100 to open. However, the monthly maintenance fee is waived if you have a balance of more than $5,000.

You can apply online in less than ten minutes without uploading any documents. If this sounds like the right solution for your business, apply with LendingClub Bank today.

How to Find the Best Online Business Bank Account for You

Not all of the online banks on our list will be a viable solution for your business. You’ll need to narrow down your options based on certain factors—but which ones?

Here are the factors we believe are the most important when choosing an online bank for your business.

Fees and Balance Requirements

Monthly fees and minimum balance requirements are common when it comes to business banking accounts.

Some banks offer accounts without fees, while others let you waive the monthly fee by maintaining a minimum daily balance.

Unlike personal checking accounts, business accounts, especially business checking accounts, typically come with monthly transaction limits (more on those later). You might have to pay a fee if you exceed those limits. And the fees can add up if you’re not careful—especially once you get past the promotional pricing some banks offer.

Our suggestion: Find a good online bank that imposes no monthly fees or “non-sufficient funds” fees, if you can.

For example, Mercury is a great bank to choose if you want to save as much money as possible with your business banking. They don’t charge any fees or require minimum deposits.

Novo and Axos are a few other great banks that don’t require a monthly service fee.

Some banks require minimum balances to be maintained in your account, or else they’ll hit you with a fee. Chase is a good example of this. Though they do charge a monthly fee, they’ll waive it with a minimum daily balance.

Minimum balances aren’t typically a huge issue since most of them are pretty low. But still, it’s a consideration when looking at banks—especially if you’re a newer business.

Interest Rates

Your annual percentage yield (APY) is another factor you should consider when choosing an online business bank. This is how much interest your account will accrue from the money you have sitting in there.

Some banks offer higher APY than others. Bluevine, for one, offers 2.0% interest on your balance up to and including $250,000. That might not seem like much but it’s actually more than 50x higher than the national average (per FDIC).

That can mean you’re passively earning a few hundred more dollars each year.

Axos Bank has a variety of small business checking and savings accounts. The higher your average daily balance, the higher the APY of your checking account.

For example, with an average daily balance of $5,000, you can earn up to 1.01% APY with an Axos Business Interest Checking account.

While interest rates should play a factor in your online business banking search, there is one thing we recommend: Don’t rate chase. That means don’t make interest rates the BIGGEST factor that plays into your bank choice.

It’s very easy to do that when banks float impressive-sounding interest rates. But, you have to remember that interest rates are only one ingredient in the bigger recipe of a good business bank.

Transaction Limits

Many business banks impose transactional limits on their business checking accounts. If you exceed that limit, you might have to pay up to $0.50 per transaction. Banks do this because they need to have money in reserve to fulfill all of their customers’ needs.

For example, Axos Financial gives you 200 free transactions per month. If you exceed that, they’ll charge you up to $0.30 per transaction.

This could potentially add up over the year, especially if you’re a business that requires frequent transactions.

If you’re a larger company, you’ll need higher transaction limits as you’ll be conducting more transfers, withdrawals, and deposits. You’ll want to be aware of fees incurred by heavy usage, and should keep an eye on the limits each banking provider gives you along with their APYs.

Luckily, banks like Bluevine and LendingClub Bank let you do unlimited transactions per month at no extra cost to you.

Custom Solutions and Support

Your business structure and industry will both have a significant impact on finding the right online banking solution for your needs.

For example, it’s common for many online business banks to offer tools for startups, sole proprietors, and freelancers. Novo definitely falls into this category, as it integrates seamlessly with other third-party tools geared toward entrepreneurs.

Other banks provide solutions for businesses operating in person. Square is a great service to turn to if you’re looking for hands-on merchant services like a POS system.

You’ll even find some banks with niche-specific options for industries such as nonprofits.

Lending options should also be taken into consideration. If you’re interested in small business loans or real estate loans, you’ll want to see what these different banks offer along those lines too. The same is true if you need a business credit card.

Even if you don’t need a loan or credit card right now, it’s helpful to find a bank that offers these types of services for your needs in the future.

In-Person Banking Availability

This isn’t the biggest deal breaker. But we understand it can be very important to some readers to have a bank that they can actually visit.

While online banking offers a wide variety of benefits, physical banks have their upsides too. With physical branches, you’ll have a much easier time depositing and withdrawing cash. So any business that accepts cash will likely need the option to visit a branch.

You’ll also be able to talk to an actual human about your needs and issues. When it comes to something as important as your business, it’s tough to replicate face-to-face banking with online support.

If you’re a business that deals a lot with international currency, you’ll definitely want an in-person bank you can go to in order to exchange currencies at a fair rate.

Businesses that offer tax guidance also may need to lean on brick-and-mortar banks, because of all the receipts, invoices, and documentation involved.

Chase is an obvious standout for this consideration. They have more than 5,000 physical locations in the United States. Just verify that there is a branch in your area. In-person banking is useless if you have to drive hours to make a deposit.

Consider the availability of ATMs in your area as well. The ability to withdraw cash without extra fees or get reimbursed for ATM withdrawals from other banks may be enough to outweigh the fact that your online bank doesn’t have physical branches.

Promotional Offers

It’s common for online business banking solutions to incentivize sign-ups with welcome offers. This can range anywhere from $300 to $750 or more just for opening a new account.

But make sure you read the fine print on these deals. You’ll likely need to make some qualifying actions, such as meeting a minimum open deposit requirement, maintaining a certain balance for three to six months, using your debit card, and more.

The terms vary based on the bank and offer. If you were planning to do this stuff anyway, then this can be a great way to earn some free cash.

But we don’t recommend choosing your bank based solely on a new customer welcome offer. Make sure the account checks all of the boxes that your business needs. If you’re able to make some quick cash on top of that, it’s a cherry on top.

Best Online Business Banking: Your Top Questions Answered

The Best Online Business Banking in Summary

Every great bank needs to have online services for business customers. Some banks offer online-only access, while others provide online banking services mixed with physical branches.

If your business takes cash, you’ll need a bank that accepts in-person deposits. Otherwise, online-only banking can accommodate the needs of most companies, even ones that accept checks and sell products online.