Opinions expressed here are the author’s alone, not those of any bank, and have not been reviewed, approved or otherwise endorsed by any of these entities.

Want to jump straight to the answer? The best business checking account for most people is Chase Business Complete Banking® or Bluevine.

Whether you’re running a large company or a side hustle, you’ll need to separate your business transactions from your personal finances.

Get an account set up in minutes with one of our top recommended business checking providers.

The Top 10 Best Business Checking Accounts

We review each of these 10 brands and explain how to choose the best business checking account for you below.

- Chase Business Complete Banking® – Best checking account for small businesses

- Bluevine — Best business checking for small businesses and startups

- Novo — Best online business checking account with free invoicing for small businesses

- Lili — Best for small businesses poised for growth

- Axos Business Interest Checking — Online-exclusive bank with competitive

- Found — Best for freelancers and self-employed

- Mercury — Best business checking account for tech startups

- LendingClub Bank Tailored Checking — Best online business checking for unlimited cash back and transactions

- TD Business Convenience Checking Plus — Best checking account with up to 500 free transactions a month

- Huntington Unlimited Business Checking — Best business checking for large businesses with high cash flow

The majority of these are free business checking accounts. Some do have a monthly fee, but it’s fairly easy to get those waived by meeting reasonable requirements.

I’ll give you an in-depth review of the top business checking accounts. We’ll cover the top features, benefits, prices, and any potential drawbacks that should be taken into consideration when choosing a business checking account below.

The Best Business Checking Account Reviews

Chase Business Complete Banking® – Best Checking Account For Small Businesses

Chase Business Complete Banking® is a great solution for small businesses that need a traditional range of checking services.

With Chase, you get the modern online business checking experience you expect from one of the world’s leading banks–24/7 access, mobile apps, and support when you need it.

But you’ll also have the ability to walk into more than 4,700 local Chase branches to handle affairs in person.

Deposit up to $5,000 cash per statement cycle without any fees. Accept payments in person and over the phone with Chase QuickAccept® card reader.

You really do get complete banking from Chase.

The online-only banks are very cheap, but they are not great for people who need a variety of account types, in-person services, or to handle cash deposits.

Chase, on the other hand, excels in meeting the needs of small business owners, no matter how they need to bank.

Top benefits and highlights of Chase Business Complete Banking® include:

- Convenient access to all your business banking services in one place — lending, checking, credit card and payment solutions.

- Unlimited electronic deposits, ACH, and Chase Quick Deposit®.

- Same-day deposits with QuickAccept®.

- Alerts to help you stay on top of your account activity.

- Easy account management through Chase Business online and the Chase Mobile® app.

- Choose from a full range of options for accepting payments and making deposits that include Zelle®, Online Bill Pay, wire transfers and ACH payments.

With all the services and support offered by Chase, it’s no surprise there is a monthly maintenance fee, which you may not have with online-only banks.

That said, there are multiple ways to waive the monthly fee, such as maintaining a minimum daily balance or making purchases on your Chase Ink® Business credit card. Meeting these or other simple criteria will drop your fee from $15 per month to $0.

Chase also offers 24/7 customer service for customers. This is fantastic for any issues, big or small, that might come up.

They offer the tools you need to manage your growing business, including some of the best business credit cards on the market today. Overall we find that Chase Business Complete Banking® is one of the best checking accounts for small businesses.

Earn up to $300 when you open a new Chase Business Complete Checking® account. This offer is for new Chase business checking customers with qualifying activities. There is no minimum deposit required to open.

Bluevine – Best Business Checking for Small Businesses & Startups

Bluevine Business Checking offers great accounts tailored to entrepreneurs.

Seriously, just take a look at some of the highlights:

- No monthly maintenance fees

- No minimum deposits or minimum balance to open an account

- No “insufficient funds” fees

- Unlimited free transactions

- 2.0% APY for eligible customers up to and including $250,000 (more than 50 times the national average!)

These features should be music to any entrepreneur’s ears.

Easily set up one-time or recurring payments through their dashboard. Also, you’ll be able to easily pay vendors via ACH, wire, or check. And if you get paid via wire transfer, there are no incoming wire fees.

Other Bluevine features include an intuitive mobile app and mobile check deposits, easily lock and unlock your business debit card for added security, a business debit MasterCard with contactless payment, and integrations with accounting tools like QuickBooks and Freshbooks, plus business tools like PayPal and Stripe.

As for downsides, there aren’t many. They have a 38,000 fee-free ATM network through a partnership with MoneyPass—though it might be difficult to find an ATM within the network depending on your location.

Bluevine does provide live support available Monday through Friday 8 am – 8 pm Eastern.

Novo – Best Online Business Checking Account with Free Invoicing for Small Businesses

Novo is an online-exclusive business checking account intended for small businesses, freelancers, and entrepreneurs.

They have transparent pricing and no hidden fees. You can apply for a Novo account in less than ten minutes online.

Some of the notable highlights for Novo business checking include:

- No minimum balance requirements

- No monthly maintenance fees

- Create up to 20 Novo Reserve accounts

- No NSF fees

- Free ACH transfers

- Free incoming wires

- Free mailed checks

Novo lets you open a new business checking account with just $50.

One of our favorite features Novo offers is its free, unlimited, customizable invoicing. You can create personalized invoices in seconds without worrying about monthly limits or extra fees. To make it even better, Novo has recurring payments for invoicing.

Integrations with Stripe, Square, and PayPal mean you can get paid via the method that works best for your business—throw in its Quickbooks integrations for accounting and financial decisions, and its Amazon integration for sales and revenue tracking, and you have everything you need in one place.

Novo is a modern simple small business banking platform sponsored by Middlesex Federal Savings, F.A. You can integrate your account with Zapier, Xero, Slack, and other tools that your small business is currently using.

Since it’s online, you can’t walk into a physical branch. So if your business has in-person financial needs, then Novo isn’t for you.

However, Novo will reimburse you for ATM fees for up to $7 per month. So you’ll still be able to access cash from anywhere without paying an extra fee, albeit not unlimited.

Lili – Best for Small Businesses Poised for Growth

Lili offers flexible online banking services for every type of business, including single- or multi-member LLCs, general partnerships, limited liability partnerships, S corporations, and sole proprietors.

It’s everything you need, nothing you don’t, at a price tag that’s nearly impossible to beat.

It takes about three minutes to sign up for the free version of Lili. You’ll get an online checking account with no minimum deposit, a Visa debit card, and tools to plan for taxes.

It’s really a great all-in-one solution that helps you move money quickly, account for taxes, track expenses, and stay on top of your business.

Lili is focused on helping businesses of all sizes manage finances and stay organized. Lili provides a great suite of services in a simple platform that’s easy to master. A few of the key highlights of a free Lili Basic checking account:

- Modern mobile banking app

- Lili Web for managing your accounts in a web browser

- No monthly fee or minimum balance

- No ACH bank transfer fees

- Tax and expense tracking

- Visa Business debit card

- ATM fees waived at 38,000 locations

You have the option to upgrade your free Lili Basic account to a Lili Pro account for $15 per month. With Lili Pro, you’ll be able to send invoices, get advanced tools for taxes, overdraft protection, and cashback rewards for your debit card. You’ll also enjoy a 4.15% APY on savings account balances when you go Pro.

To see how simple and stress-free online banking can be, get started with a free Lili account today.

Axos Business Interest Checking – Best Online-Exclusive Bank with Competitive Returns

Axos Business Interest Checking offers an excellent online-only checking service with no annual fees.

Some great features of the Business Interest checking account:

- Earn up to 1.01% APY

- $100 minimum opening deposit

- Pay no monthly maintenance fee with an average daily balance of at least $5,000

- Up to 50 free items per month, $0.50 per item thereafter (includes debits, credit, and deposited items)

- Up to 60 items per month for Remote Deposit Anywhere (includes monthly per item processing limitation)

- Unlimited domestic ATM fee reimbursements

- No annual fees

- Cash deposits via MoneyPass and AllPoint networks

The online and mobile banking solutions from Axos are exceptional, as you would expect from an online-exclusive bank. You can also deposit a check from anywhere using your mobile device.

Any newly incorporated business that maintains a minimum average daily balance of $50,000 can earn a $400 bonus just for opening a business checking account by January 31st using the promo code NEW400 on their application.

Overall, Axos Business Interest Checking is suitable for small business owners with modest banking needs.

Found – Best for Freelancers and Self-Employed

Found is an all-in-one business checking solution designed for people who work for themselves.

There are no account fees, no minimum balance, and no hassle signing up. It’s everything a self-employed business owner needs–and nothing they don’t.

You’ll be able to bank anywhere with the modern Found app. If you need to make payments in person, simply activate your new Mastercard business debit card.

The app is incredibly easy to navigate and allows you to handle way more than just business checking. Some of the other highlights include:

- Professional invoicing

- Expense and tax tracking

- Auto-generated business reports

- Apple Pay and Google Pay integration

- External account linking

- No overdraft of minimum balance fees

Getting paid by your clients and customers is very easy with a Found checking account.

Create professional looking invoices and start taking ACH payments immediately. You can also connect a variety of payment gateways like PayPal, CashApp, Venmo, eBay, and other popular options.

If you want, Found will calculate your quarterly tax payments and automatically set aside the money you owe inside your account. Little by little, you’ll have what you need to make quarterly payments a breeze.

With Found+, an option premium subscription, you will be able to create more customized bookkeeping rules, scan receipts to track expenses, and pay your quarterly taxes directly in the app.

Many self-employed business owners will be fine with a Found’s core online banking service, which has no required fees.

Found’s banking services are online only, so you won’t be able to create paper checks or walk into a branch.

I wouldn’t hitch your wagon to Found if you are planning on hiring full-time employees, running a non-profit organization, or managing your business with an S-corp.

If you are self-employed, Found is simply going to work better. You can avoid account fees and get a much simpler online banking experience by choosing Found, which wasn’t designed for massive organizations.

Have an LLC, that’s great–if you don’t, that’s fine too. You will sign up for Found in your own name, and you can add an EIN once you have an account.

Please note that Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The Found Mastercard® debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

The entire signup process only takes a few minutes. Open your Found account today.

Mercury – Best business checking account for tech startups

Mercury* is an online financial service and technology company providing business checking and savings accounts aimed directly at tech startups. With no fees for domestic and international wires, no minimum balances, and automatic cash management tools, Mercury is a great option for tech-focused small businesses and startups.

Mercury lets you open FDIC-insured checking and savings accounts to store all deposits. Issue debit and credit cards tied to these account with custom limits you set and you can integrate Mercury accounts with QuickBooks, Xero, Gisto, Shopify, Stripe, PayPal, and more for improved functionality and visibility.

Startups can grow with Mercury, whether you’re supercharging fundraising with minimally dilutive loans from Mercury Venture Debt, meeting investors, mentors, and other founders through Mercury Raise DTC, or getting matched with the right financing options for your business with Mercury Capital.

You’ll also get access to Mercury Treasury, an automatic cash management account that puts money into securities and money market funds.

Perhaps the best feature of all for tech startups, though, is the Mercury Vault. This ultra-safe way to store cash powered by Mercury’s partner banks in Choice Financial Group and Evolve Bank & Trust (both members FDIC) gives you peace of mind that other startup-minded fintech companies can’t by FDIC-insuring deposits up to a whopping $5 million. That’s well over the standard minimum of $250,000 you’ll find others offer.

An important note is that Mercury is not currently available to sole proprietors, and is largely marketed to startups and growing companies. But, it’s expanding its client base constantly with new offerings, and it offers a broad knowledge base and tools well-suited to tech startups. Apply for an account now.

*Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust, Members FDIC.

LendingClub Bank Tailored Checking – Best Online Business Checking For Unlimited Cash Back and Transactions

LendingClub Bank Tailored Checking offers a very lucrative online business checking account that offers unlimited cash back.

You’ll also be able to immediately start earning 1%+ cash back on “signature-based” credit transactions that you make using their debit card. It takes just minutes to open an account too and you can get started as soon as you do.

Couple that with their unlimited transactions along with their ATM fee reimbursement, and this makes LendingClub Bank’s Tailored Checking a very good option for bootstrap businesses and entrepreneurs.

Here’s a more comprehensive list of their standout features:

- 1.50% APY on balances up to $100,000, then 0.10% APY on anything above that amount

- Unlimited ATM transactions with fee rebates

- No monthly fee for balances more than $5,000

- No minimum balance required

- Intuitive mobile app

- 1% cash back on certain credit purchases

- Unlimited transactions

- Integrations with Mint, Quickbooks, and Quicken

Overall, LendingClub Bank offers a very solid digital business checking account. Get started in less than 10 minutes today.

TD Business Convenience Checking Plus – Best Checking Account With up to 500 Free Transactions a Month

You can open a TD Business Convenience Checking Plus account with just $100. However, you’ll need to maintain a $1,500 daily balance to waive the $25 monthly maintenance fee.

If you link a personal checking account to your Business Checking Plus account, TD Bank counts your combined balance between the two accounts toward the daily minimum. So this is a great choice for business owners who already have an account at TD Bank.

Let’s review some of the account benefits:

- 500 free transactions per month

- Up to $5,000 in cash deposits per cycle

- Overdraft protection

- Online statements and mobile deposit

- Up to four signers

While TD Business Convenience Checking Plus does have a high maintenance fee, you’ll benefit from more free monthly transactions. For comparison purposes, Chase Total Business Checking has a $15 fee for just 100 free transactions each month.

Plus, it’s easy to waive TD’s $25 fee by maintaining a low combined balance between two accounts.

Even though you’re limited to $5,000 free cash deposits each month, you’re only charged $0.25 per $100 thereafter. So an additional $5,000 cash deposited in a cycle ($10,000 total) would cost you $12.50. That’s just 0.13% of your deposits, which is next to nothing.

TD Bank gives you access to other services, like merchant solutions, business loans, and business lines of credit.

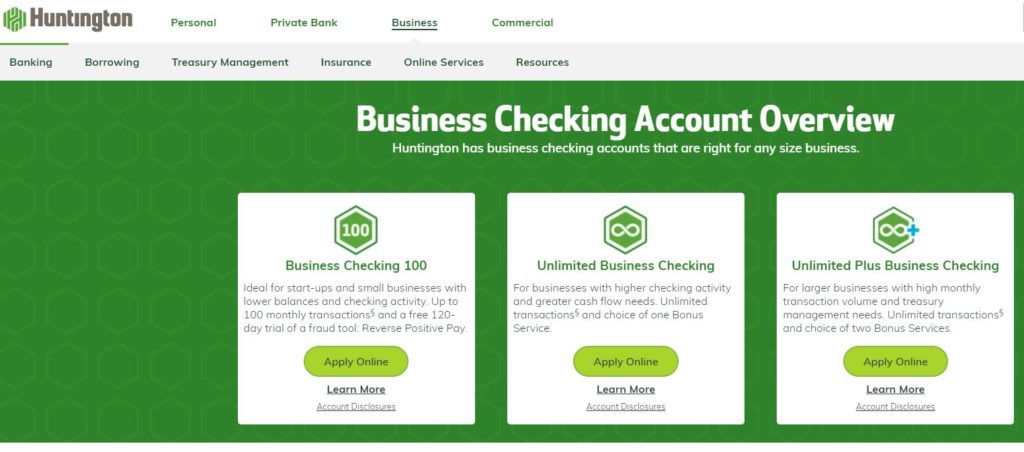

Huntington Unlimited Business Checking – Best Business Checking For Large Businesses With High Cash Flow

Huntington Unlimited Business Checking is a top option for larger organizations. If you have a higher monthly transaction volume, some of the other accounts on our list won’t fit your needs.

The top features and benefits of Unlimited Business Checking from Huntington include:

- Unlimited transactions

- Overdraft protection

- Online and mobile banking

- Free text and email alerts

- Up to $10,000 free cash deposits each month

Huntington does charge a $20 monthly maintenance fee for this account. But it’s waived with a $10,000 combined balance between all of your eligible Huntington Bank accounts.

With an Unlimited Business Checking account, Huntington Bank allows you to choose one of the following bonus services as well:

- Fraud tool

- Huntington deposit scan (up to 50 per month)

- 10% off payroll services

- Two free incoming domestic wires per month

- Returned deposited items (up to 25 per month)

This bank also has a tool called “The Hub” for business checking accounts. It comes with several digital tools for things like cash positioning and cash flow forecasting. The Hub is a great resource for managing your revenue and expenses.

How to Find the Best Business Checking Account For You

All business checking accounts are not created equally. The best choice for one business might not be ideal for yours.

This is the methodology that you should use when you’re evaluating business checking accounts. I’ll explain each feature in greater detail below.

Fees

Service fees and monthly maintenance fees are common for business checking accounts. In most cases, these fees fall somewhere in the $10 to $50 range.

But there are still plenty of free business banking solutions. In fact, seven of the eleven accounts on our list don’t have monthly fees.

While the remaining four contain fees, you can easily waive them by maintaining a minimum account balance. There’s no reason to pay these fees if you can avoid them.

Balance Requirements

Some banks require a minimum opening deposit. So choose a bank with a reasonable opening deposit minimum based on your situation.

If you’re launching a startup and don’t have a ton of cash on hand, you can open some accounts with as little as $50 or $100. Some banks don’t require a minimum opening deposit at all.

In addition to the opening deposit requirement, some accounts will charge for you falling below a certain minimum daily balance. Make sure that your cash flow is enough to maintain your minimum requirements without getting penalized.

Transaction Limits

Personal checking accounts will rarely, if ever, cap the number of transactions you can make in a billing cycle. But that’s not the case for most business checking accounts.

Depending on the bank, activities like deposits, withdrawals, and transfers count toward a monthly limit. Some banks will restrict the number of in-person transactions you can make while offering free unlimited electronic transactions.

For the most part, free monthly transaction limits start at 100. TD Business Convenience Checking allows for 500 free transactions per month. Other banks give you unlimited transactions, with a few contingencies.

You’ll pay a small fee for each transaction over your monthly limit. This is usually somewhere in the $0.25 to $0.50 range.

Mobile Banking and Online Accessibility

Every bank offers some way to access your account online or through a mobile app. But with that said, some of these digital solutions are definitely better than others.

Choose a business checking account that lets you deposit checks remotely, set up account alerts, and pay invoices automatically.

I do nearly all of my business banking from a mobile app, and I’m sure you’ll want that convenience as well.

Branch Locations

Some banks are region-specific, while others are large national chains. It’s important to choose a bank near your business location if you need to access a branch for anything.

However, there are several business checking accounts that are online-exclusive. These banks don’t have any physical locations, and can be a huge advantage if your transactions are exclusively digital.

Online-only banking is very popular for freelancers and entrepreneurs working remotely.

But those solutions aren’t for everyone. For example, if your business accepts cash, you’ll definitely need access to a physical branch for in-person deposits.

Additional Banking Services

This may not be important to you immediately, but it’s nice to have a bank that will provide you with additional services as your business grows.

Whether it’s merchant services for credit card processing, additional accounts like a business credit card, a business loan, or line of credit, it’s easier to get these from a bank where you have an existing relationship.

Always look at what else a bank has to offer beyond your immediate checking account needs today.

The Top Business Checking Accounts in Summary

Every business owner needs a business checking account. But everyone has different banking needs, which is why finding the best business checking solution can be difficult.

For the most part, a business checking account functions like a personal checking account. However, business checking accounts typically have extra fees, minimum balance requirements, and monthly transaction limits.