Many businesses use biweekly or bimonthly payroll cycles to compensate their employees. For the most part, employees get paid twice a month with both methods, but each has several key differences that determine if it works well in a given company or industry.

Bimonthly and biweekly payments differ mainly in their payroll processing timing. However, finer details, like efficiency and the types of employees you have, will affect which one you choose. Payroll processing software can help you keep track of your pay periods and ensure that your employees get paid correctly and on time.

1. Number of Yearly Paychecks

Bimonthly or semimonthly pay cycles give employees 24 paychecks per year, two per month. Many companies issue these payments at the beginning and middle or the middle and end of each month.

A biweekly payment cycle issues a paycheck every two weeks, so employees receive two additional paychecks per year for a total of 26. As a result, employees get three paychecks during two months of the year. If the first paycheck falls on a Friday early in the month, employees will get paid on that day, another Friday in the middle of the month, and a third Friday at the end of the month.

The difference in the number of paychecks doesn’t affect how much your employees get paid—it just distributes that payment differently. For some people, getting paid biweekly makes them feel like they’re making more money, and it can be convenient since they don’t have to wait as long between pay cycles. With bimonthly paychecks, they may have to wait a few extra days.

A payroll processing service like Gusto works for many different kinds of businesses, including remote employees. It makes it easy to pay your employees, as well as onboard them, and it can automatically take out taxes and benefits when necessary. Most employers also find it easy to set up and start using it right away.

2. Payday Schedule

Neither biweekly nor bimonthly pay schedules are necessarily better than the other, but many people prefer the regularity of the biweekly schedule. They know they’ll always get paid on the same day of the week every two weeks.

With bimonthly pay, the schedule varies and focuses on dates rather than intervals that depend on the number of weeks between. The schedule can become slightly offset depending on how many days there are in the month. For example, with 28 days in February, employees get paid sooner than in months with 31 days.

Bimonthly pay cycles must also factor in weekends and holidays. If a company pays its employees on the 15th and the 30th of every month, for example, and the 15th falls on a Sunday, or the 30th is a holiday the company has off, the payroll must be adjusted. Employees either get paid early, or they will have their pay delayed.

The offset schedule usually isn’t a problem since employees still get paid the same amount, but it can throw a wrench in employees’ plans and needs. It also complicates the payroll process.

In short, biweekly pay uses a day of the week to mark payday, whereas bimonthly disregards the days of the week—aside from weekends and holidays—and pays according to the date.

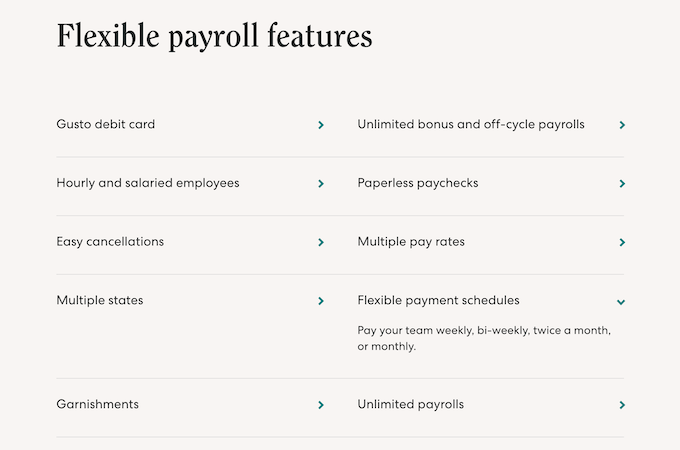

Gusto tracks your employees’ lunchtime and breaks, and it works well for any pay schedule, including biweekly and bimonthly. It comes with advanced and flexible payroll features that help you schedule your tasks as needed to keep everything running smoothly. It makes it easy to manage your pay periods from anywhere and gives you insights and reporting to see where you can improve your process.

3. Paycheck Amount

Due to the slight difference in the length of each pay period for biweekly and bimonthly pay, employee paycheck amounts vary slightly. With bimonthly pay, they see more money on payday since fewer paychecks mean a higher amount per pay period.

For example, someone who makes $50,000 per year with biweekly pay and 26 paychecks would see a gross amount of about $1,923 per pay period. On a bimonthly pay schedule, it’s $2,083 per paycheck. Overall, they still make the same amount per year, but the increments look slightly different.

The amount per pay period doesn’t change how much gets taken out in taxes or benefits. Since it’s still the same amount earned, the deductions are also the same.

With biweekly pay, the amount tends to be consistent per paycheck, though it can have small variations with bimonthly pay, since there may be more or fewer days in one month versus others. Many people prefer biweekly pay for this reason.

Gusto tracks paycheck amounts for you, so you and your employees always know how much they’ll receive each pay period. Its full-service payroll integrates with your other tools and auto-calculates taxes and other more advanced factors to minimize mistakes.

4. Frequency of Use

Popularity isn’t an inherent difference between the two payroll systems, but one is more widely used than the other. Overall, more companies use biweekly pay for its consistency and ease of use. When payroll gets processed on the same day every week, it gives employees more certainty about when they’ll get paid and reduces the likelihood of those in charge of payroll forgetting to process it mid-week, as they might with bimonthly pay.

According to the Bureau of Labor Statistics, a February 2022 survey showed that 45.7% of employees in the United States get paid biweekly. In comparison, only 18% get paid bimonthly. The rest get paid either weekly or monthly.

The survey also showed that larger companies tend to use the biweekly system, while the statistics for most companies with fewer than 50 employees showed about equal use of weekly and biweekly pay. For smaller businesses, bimonthly pay was used much less frequently.

The discrepancy between biweekly and bimonthly pay period popularity only widens as companies grow. The survey showed 64% of companies with 25-499 employees using biweekly pay and only 12% using bimonthly. That 12% is also only half the percentage of those using weekly pay periods.

The survey laid out which industries tend to use different types of pay cycles. While half of them mainly used biweekly pay, only the Information industry favored bimonthly pay among the 10 industries shown.

The difference in popularity comes down to many factors, including the type of work employees do in a given field, schedule type, regulations, and even company preference. Not all companies in the same industry work the same way, so the pay schedule varies based on the work environment and employee needs.

Gusto works across industries, and it organizes all your employee payroll information, including forms and signatures. Most users find Gusto easier than their last provider, and it has several automatization capabilities that work for any payment schedule you choose.

5. Payroll Efficiency

With biweekly pay, payroll processing is more efficient. You can schedule tasks at the same time every week and perform them on the same day, making it easier to build into a schedule. This also reduces the burden on payroll staff, as they can more effectively schedule their time and automate repetitive tasks.

Fewer adjustments also free up more time for important work. It allows payroll to work faster when entering payroll information and processing time off when they don’t have to think about correcting preventable mistakes. Biweekly pay is also more efficient because employees typically require fewer reminders and can build recording their time and making necessary changes to their work week. As a result, it creates a better workflow with scheduled processes.

You can still use Gusto and other payroll services to automate tasks with bimonthly pay, but you’ll also have to adjust based on weekends and holidays, which doesn’t happen as often with biweekly pay. Gusto syncs your other platforms to payroll, too, to make scheduling and processing quicker.

Customers report that running payroll takes about 13 minutes with Gusto. It allows you to automate repetitive tasks to free up time for running your business and lets your staff focus on work that benefits your business.

6. Payment Processing Confusion

With biweekly pay, employees know exactly when they should submit their payroll information since it’s the same every time. Processing also occurs on the same day for payroll employees. With regular payments on the same days, employees require fewer entry adjustments at the end of the pay period.

For example, with bimonthly payments, employees may not realize that they have to enter their house or time off on a Tuesday during one pay period and a Thursday the next. A changing schedule like this can cause confusion, disrupt standard practices, and upset employee schedules.

Biweekly pay is more consistent and easier to understand for both employees and the person processing payments. Payroll can also become more confusing depending on the type of employees you have, but we’ll get to that in the next section.

Gusto has built-in financial tools with Gusto Wallet. The platform helps employees manage their time and paychecks, too, so everyone benefits. Gusto also has advanced features that make payroll less confusing by helping you manage deductions, pre-tax benefits, tip credits, payroll reports, and more.

7. Types of Employee

The payroll system you use and whether it works well depends in part on the types of employees you have. Salaried employees earn the same amount of money per pay period, or even per year, no matter how many hours they work, because it’s built into their contract. For hourly employees, it depends on the number of hours they work, which can vary each week.

Bimonthly pay can become confusing with factors like overtime pay for hourly employees. On the other hand, it makes things more efficient for salaried employees because they don’t have that information to put in. For hourly employees, bimonthly pay can also create an issue with scheduling, especially if your company schedules by the week and payday changes with each cycle.

With so many employees working varied hours, like a night shift as opposed to a 9-to-5 workday, it can complicate the payroll process more with bimonthly pay. A biweekly schedule allows employees to enter their payroll information according to their schedule for the same two weeks every time.

Gusto helps you manage all types of employees, whether you need it for salaried or hourly workers. It even works well for remote freelance teams, and you can organize all your employee information by department. Its paperless onboarding makes welcoming new team members easy, and the platform handles all your direct deposit and digital pay stubs.

8. Payroll Processing Costs

Every business with employees should have a payroll processing service, and each service charges you to use it. Many charge based on the number of transactions per month.

With bimonthly pay, the cost of payroll processing will always be the same since employees will always get paid twice per month. With biweekly pay, you’ll need to budget twice a year for an extra transaction since two months have three paydays. This is one of the few areas where bimonthly payroll has the advantage and more consistency than biweekly pay cycles.

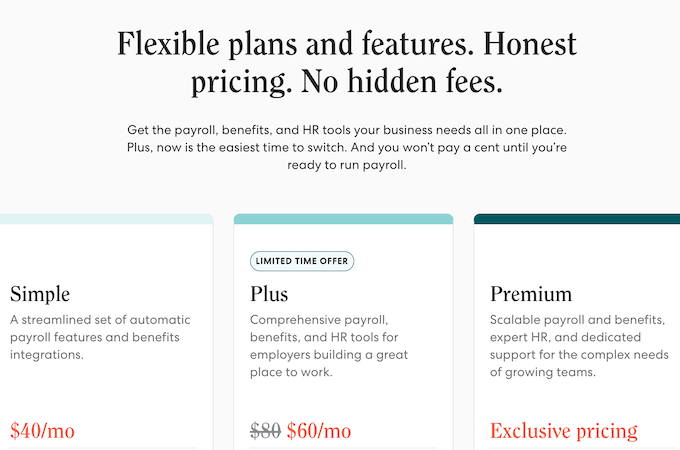

Gusto gives you unlimited payrolls with upfront pricing. The platform starts at $40 per month, plus $6 per person, for its entry-level Simple packages. When you upgrade to Plus, the cost doubles to $80 per month, plus $12 per person. For the most advanced features in the Premium plan, you’ll need to contact sales for custom pricing.

The Similarities Between Bimonthly and Biweekly Pay

With biweekly and bimonthly pay, your employees receive the same total amount per year. Both typically pay twice a month.

Salaried employees are less affected by both payment methods since their contracts state they receive the same payment amounts regardless. It’s up to the business owner to decide how they want to pay employees, which makes bimonthly and biweekly pay viable options for most businesses. Some labor laws dictate industry pay schedules, but that varies and usually applies more to weekly payroll cycles rather than bimonthly or biweekly ones.

For both bimonthly and biweekly pay, taxes are always the same. Employees will have the same amount taken out of their paychecks for insurance and other benefits, too, no matter how you choose to pay them. In terms of the frequency of payment, biweekly and bimonthly differ, but overall, they’re similar in most ways aside from timing and convenience.

Final Thoughts About Bimonthly and Biweekly Pay

Biweekly and bimonthly pay both have their advantages, though the benefits vary between industries, employee type, and ease of use. More than anything, the difference lies in the schedule. Both systems typically pay twice a month, except for the two months per year with a third biweekly payday. The bimonthly schedule can also shift due to holidays and weekends.

Payroll services like Gusto can help you keep track of your payment schedule and automate repetitive payroll tasks for both biweekly and bimonthly schedules. Bimonthly pay works better for salaried employees, whereas biweekly often benefits hourly workers. Overall, for many industries, biweekly pay is more popular and reduces confusion when processing payroll.

Above all, it’s important to choose the payroll process that works best for your employees and business. Consider the costs of each type of pay cycle, too. There’s no one correct way to process payroll for every company, so it comes down to assessing your individual company needs.