Want to jump straight to the answer? The best billing and invoicing software for most people is BILL or FreshBooks

Collecting payments from clients and customers can be challenging. Ineffective invoicing systems can create serious cash flow problems.

For service businesses, freelancers, and B2Bs, billing and invoicing software can simplify your payment collection process. You’ll get paid quicker while simultaneously giving your customers more convenient options to pay.

The Top 7 Best Billing and Invoicing Software

- BILL – Best intuitive interface and automated workflows

- FreshBooks – Best all-in-one billing and invoicing software

- Square – Best for low-volume invoicing

- Zoho Invoice – Best automation features

- Xero – Best invoicing software for small businesses

- Wave – Best free billing and invoicing software

- Invoicely – Best simple billing and invoicing software

After researching and testing dozens of different billing and invoicing solutions, we’ve narrowed down seven that we can confidently recommend. Continue below for in-depth reviews containing the features, benefits, pricing, and use cases for each tool on our list.

BILL – Best Intuitive Interface & Automated Workflows

BILL is a great billing and invoicing solution with an intuitive user interface that anyone can use without needing training. It is not a full suite accounting tool — there are no payroll or inventory management functions. Instead, BILL calls itself a business payment platform.

When you log into your account, you’ll see five options with short summaries of any upcoming due dates, overdue bills, etc.:

- Bills to Pay

- Open Invoices

- Bill Approvals

- Payments In

- Payments Out

Additional menu items are found in a list on the left side of the screen, and tucked into the right side is a handy to-do list. BILL integrates with major accounting software like QuickBooks, Xero, and Oracle, further expanding its functionality.

One of our favorite features is that you can provide a custom BILL email address to your vendors and have them send bills directly to the site. The service will automatically grab the invoice’s due date, amount, and pertinent information into the BILL form. All you have to do is select the vendor from a list, add a short description, and authorize payment.

BILL has four levels of pricing and plans:

- Essentials – $45 per user per month

- Team – $55 per user per month

- Corporate – $79 per user per month

- Enterprise – Customized pricing

You can test BILL with a risk-free trial now.

FreshBooks — Best All-in-One Billing and Invoicing Software

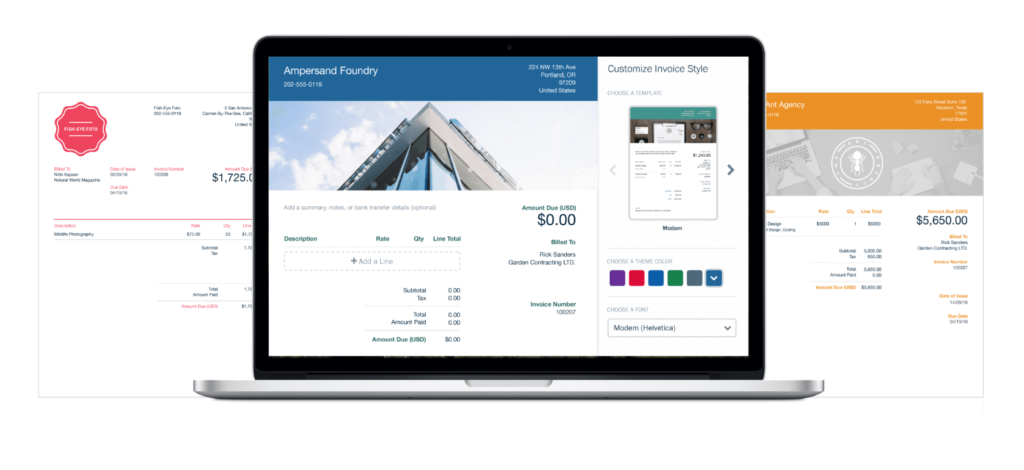

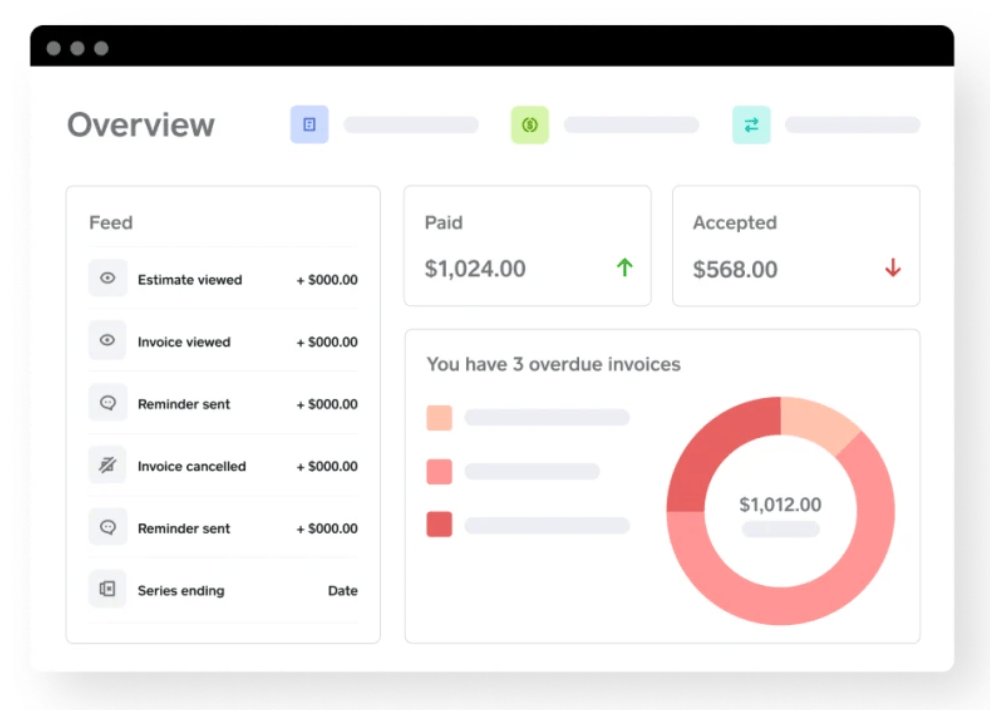

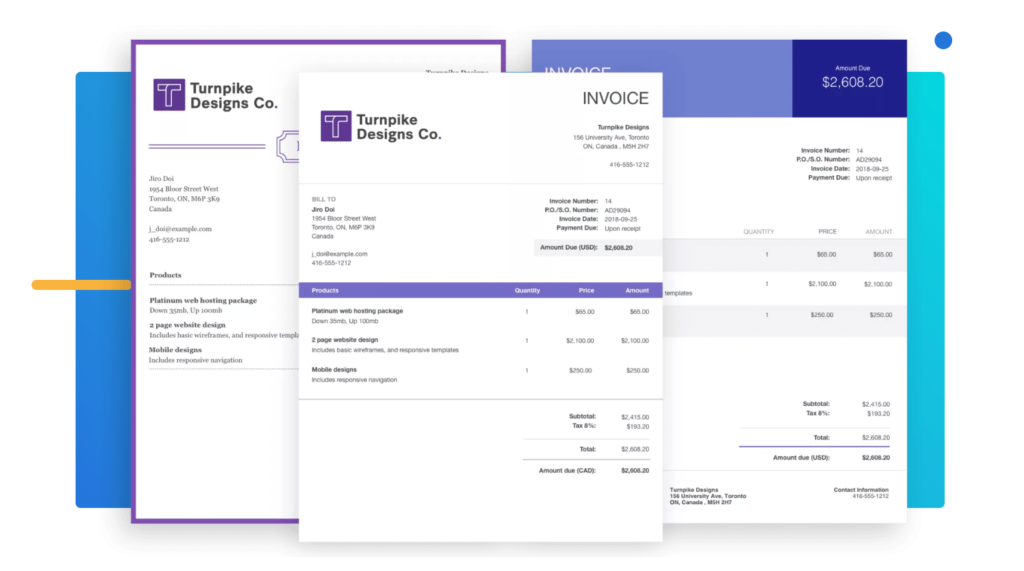

FreshBooks is an all-in-one tool for invoicing and accounting software. It’s a top choice for small businesses, self-employed individuals, firms, agencies, and consultancies.

With FreshBooks, it’s easy to create a professional invoice in just a few seconds. Just use the invoice generator to choose a template, add your logo, and personalize an email.

FreshBooks has an integrated payment solution as well. You can accept credit cards and ACH payments to get paid faster.

You’ll also benefit from automation features to put your billing system on autopilot. Create recurring invoices, send payment reminders, and charge late fees—automatically.

Another top feature from FreshBooks is the ability to collect deposits as a flat amount or percent of the total invoice.

Use FreshBooks to customize payment terms, add due dates, automatically calculate taxes, and so much more. As an all-in-one accounting solution, you’ll also have tools for time tracking, expenses, payments, projects, and reporting.

FreshBooks has a plan for businesses of all shapes and sizes:

- Lite – $17 per month (5 billable clients)

- Plus – $30 per month (50 billable clients)

- Premium – $55 per month (Unlimited billable clients)

- Select – Custom pricing (Unlimited billable clients)

For a limited time, FreshBooks is offering 50% off the first six months for new customers. Try it free for 30 days.

Square — Best For Low-Volume Invoicing

Square is best known for its POS software and payment processing solutions. But it’s also a viable option for billing and invoicing.

With Square, it’s easy to send digital invoices to your clients from anywhere online.

More than 200 million invoices have been sent via Square. The platform has facilitated $45+ billion invoice transactions from 70+ million customers worldwide.

Square lets you save customer cards on file for auto-billing and recurring invoices. They also have a wide range of invoice templates for industries like client services, retail, field service, and freelance.

The main advantage of Square is it’s built-in payment processing. It’s easy for your clients to pay invoices from anywhere with just a few clicks.

There’s a plan with no monthly fee, and you can send an unlimited number of invoices and estimates. You’ll only pay a processing rate of 3.3% + $0.30 per invoice paid online. That rate jumps to 3.5% + $0.15 for card on file transactions.

These rates are a bit high for payment processing, in general. But it’s fine if you’re not doing a high volume of monthly invoices.

For $20 per month, you can access the Plus plan. This package is designed for growing businesses and includes advanced features like batch invoicing, custom invoice layouts, and the ability to track open or completed projects.

Zoho Invoice — Best Automation Features

Zoho Invoice is a cloud-based software that allows you to create professional invoices, send payment reminders, and get paid quickly online.

Unlike some of the other tools on our list, Zoho Invoice is not an all-in-one accounting solution. But Zoho has everything you need to automatically send and manage your invoices online.

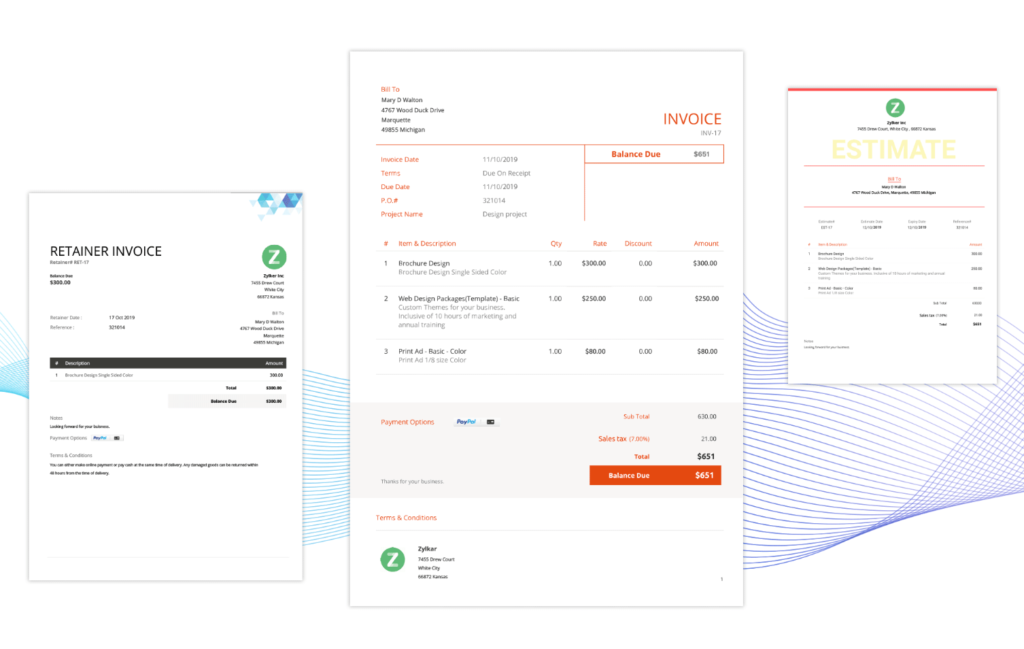

Zoho Invoice has an extensive catalog of invoice templates for different categories, including retainers and estimates. It’s easy to create detailed invoices with custom fields while staying organized and emulating professionalism.

You’ll also be able to manage all of your company’s tax compliance with the appropriate tax charges on every invoice.

One of my favorite features of Zoho Invoice is the recurring billing profile. It’s easy to set up automated payments for repeat customers. Zoho will even let you know when clients have viewed an invoice, so you won’t have to guess if it was received.

In addition to basic billing features, you’ll also benefit from tools for managing payments, time tracking, and expenses. Simply integrate with your payment gateway to get paid online.

Zoho Invoice is now available free of charge.

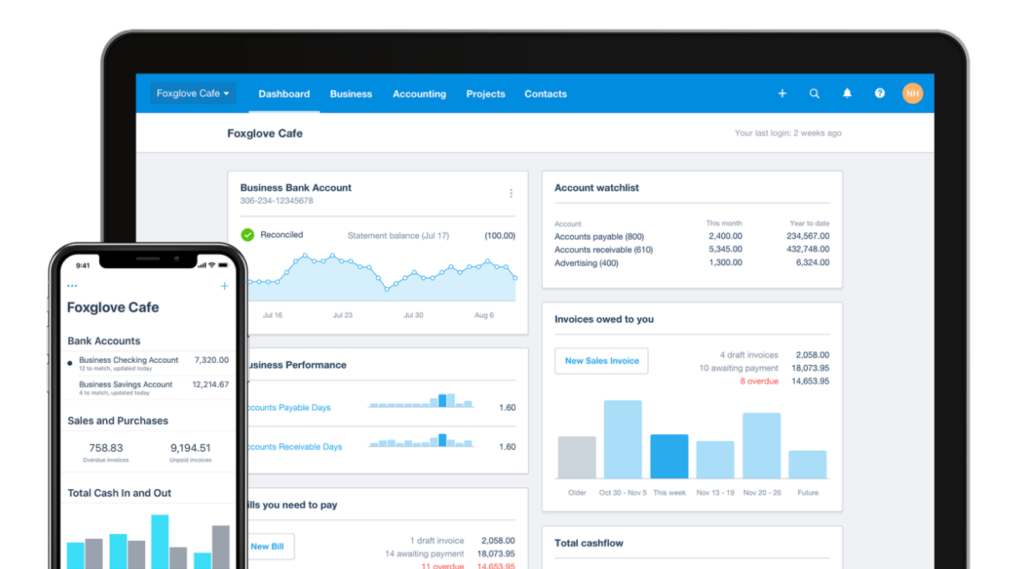

Xero — Best Invoicing Software For Small Businesses

Xero is another all-in-one accounting tool designed for small businesses. As cloud-based software, it’s easy to manage your invoices and financials from anywhere.

Creating professional and personalized invoices is simple. Choose a template, add your branding, upload your logo, and you’re ready to start sending professional invoices to clients.

With Xero, you’ll benefit from billing features like:

- Automatically set up repeat invoices

- Send bulk invoices

- Mobile invoicing

- Instant payments with “Pay Now” button

- Oncharge billable expenses

- Replicate previous invoices

Xero doesn’t have a built-in payment processing tool. But they work with Stripe and GoCardless for credit, debit, ACH, and digital wallet acceptance. So it’s easy to set up and start accepting payments online.

The software integrates with 800+ other apps and tools, including Gusto, Insightly, Expensify, PayPal, Bill.com, Square, Shopify, and more.

Here’s a quick look at the Xero plans and pricing:

- Early — $13 per month

- Growing — $37 per month

- Established — $70 per month

The Early plan limits you to just 20 invoices and quotes per month. So most of you will likely start at the mid-tier plan. You can try all of Xero’s features with unlimited users free for 30 days.

Wave — Best Free Billing and Invoicing Software

Wave is a 100% free billing and invoicing solution. It’s a great option for freelancers, entrepreneurs, and small businesses that want to improve their billing procedures.

With Wave, you’ll be able to create and send an unlimited number of invoices to as many clients as you want—all for free. It’s easy to use, and the templates are fully customizable.

You can manage your invoices from anywhere with the Wave iOS and Android mobile apps.

Here’s a quick overview of the other top invoicing features from Wave:

- Invoice in any currency

- Send estimates

- Turn estimates into invoices once approved

- Follow-up with overdue accounts

- Automatic payment reminders

- Recurring invoices

- Drag-and-drop line items

- Custom payment terms

- Automatic tax calculations

- Track partial payments

- See when invoices were viewed

- Cash flow insights

Accounting tools are offered for free as well.

You’ll have to pay if you use Wave’s integrated payment solution, which is billed on a per-use basis.

Credit card processing costs 2.9% + $0.60 per transaction for Visa, Mastercard, and Discover. American Express payments cost 3.4% + $0.60 per transaction. ACH payments are available as well for a 1% fee.

Receipt scanning is also available in monthly or yearly subscriptions.

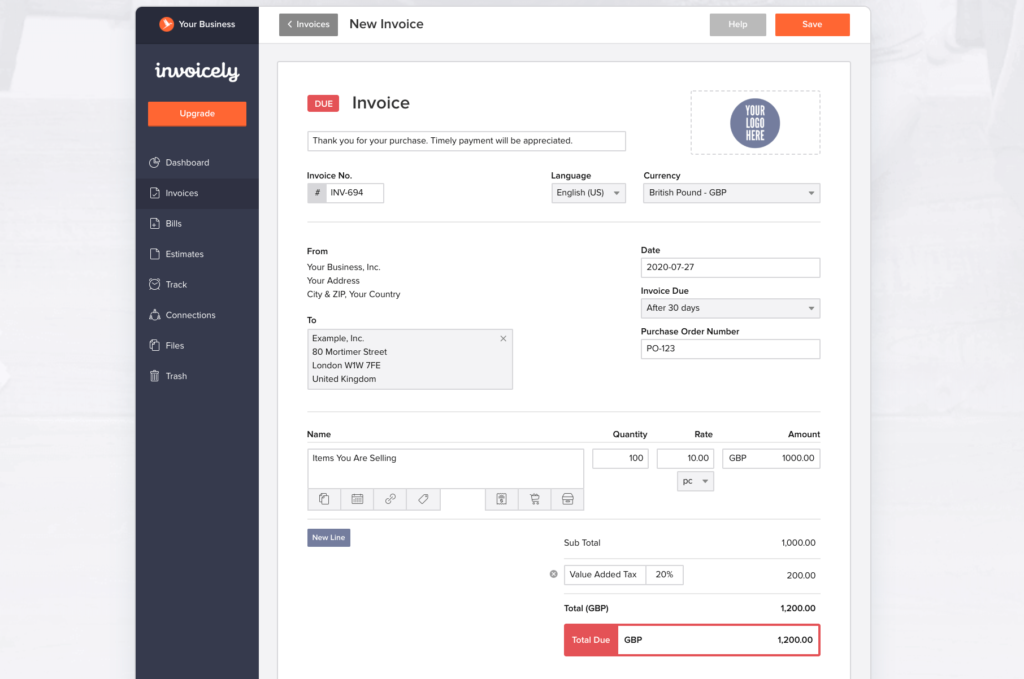

Invoicely — Best Simple Billing and Invoicing Software

Invoicely is trusted by 250,000+ businesses. It’s a simple solution, which makes it a popular choice for small businesses.

But don’t let its simplicity fool you; Invoicely is powerful and easy to use. You can create a professional invoice in less than 60 seconds.

The software isn’t quite as feature-rich as some of the other solutions on our list. But with that said, it has everything you need to manage basic invoicing.

You’ll benefit from features like recurring statements, the ability to bill in any currency, send estimates, and accept payments online. Invoicely also has tools for tracking time, miles, and expenses for invoicing.

There’s a free plan for individual users, but we can’t say that we recommend it. The invoices will have Invoicely branding on them, which isn’t very professional.

Here’s a quick look at the rates for paid plans:

- Basic — $9.99 per month ($7.99 with annual contract)

- Professional — $19.99 per month ($15.99 with annual contract)

- Enterprise — $29.99 per month ($23.99 with annual contract)

The plans are largely based on the number of team members you have. Each one can accommodate up to 2, 10, and 25 users, respectively.

If you want an all-in-one accounting solution, Invoicely is not for you. But it’s a viable option for simple online invoicing tools.

How to Find the Best Billing and Invoicing Software For You

With so many excellent options to choose from, finding the best billing and invoicing software for your business can be tough.

But there are certain features that you should be looking for as you’re evaluating different solutions. This is the methodology that we used to narrow down the winners on our list. You can use this methodology as well to find the best software for your needs.

Number of Clients

How many clients do you have? How many invoices do you send each month?

Lots of software will limit the number of invoices you can send based on your plan. So it’s important to think big-picture here as well. What happens if you get new clients? Are you able to send estimates to prospects?

Make sure your software can scale with you as your business grows.

Alternatively, there are certain tools on the market that offer unlimited invoicing—in some cases, for free.

Automation

Billing and invoicing software should make your life easier. Look for tools with automated features, so you can eliminate manual tasks for optimal efficiency.

Automation is key for recurring billing. It’s also great to have for automated follow-ups, late fees, payment reminders, and tax calculations.

Payment Collection

Sending invoices is only half the battle. At the end of the day, you still need to get paid.

The best billing and invoicing solutions have integrated payment processing tools. If those tools aren’t built-in, you should at least be able to integrate with a third-party platform.

It’s common for some platforms to offer free invoicing tools, and only charge you for processing fees. While the fees depend on factors like card type and payment method, they typically start around 2.9% + $0.30 per transaction for credit cards and 1% for ACH acceptance.

These rates are a bit high compared to traditional credit card processing. But it’s worth it to give your customers a convenient way to pay online. This will drastically reduce your average receivables time.

Accounting Tools

Lots of billing and invoicing software will allow you to do much more than just send invoices. Some are branded as all-in-one accounting solutions. There are even options out there that provide outsourced bookkeeping services as an add-on.

Examples of accounting tools include expense management, financial reports, receipt uploads, time tracking, bank reconciliation, reporting, and more.

But not every business needs a full-blown accounting solution to send invoices. If you just want to send invoices online, save your money, and choose a simple software.

The Top Billing and Invoicing Software in Summary

The best invoicing software comes with features like automated follow-up messages, expense management, receipts, tax information, and more. These tools can simplify your accounting system and make it easier to track receivables.

By using an online billing solution, it adds a level of professionalism to your business as well. You’ll be able to create professional invoices and provide better service to your clients.